The United Arab Emirates (UAE) is an economic powerhouse in the Middle East, pulling in global investment and giving space to innovative industries. Dubai is at the heart of this commercial trade in the UAE. So, if you are a British entrepreneur looking for business opportunities in Dubai, then there are plenty.

The UK and the UAE share a deep-rooted commercial history bolstered by enduring friendship and collaboration. Economic exchanges span various sectors, showcasing their commitment to a robust partnership. Bilateral platforms like the UK-UAE Business Council and others drive joint growth and business opportunities in Dubai from the UK.

Here’s an overview of the UAE business environment:

Let’s break down statistically why company formation in Dubai is a smart move, especially for UK entrepreneurs:

- The UAE and the UK: A Thriving Business Partnership

There are over 6,000 UK businesses in the UAE. This shows that the country’s appeal lies not only in world-class logistics but also as a hub for emerging markets and business opportunities in Dubai – with bilateral trade exceeding £25 billion.

As the largest recipient of UK foreign direct investment in MENAT, the UAE is a pivotal post-Brexit market. In 2019, FDI from the UK in the UAE reached £7.8 billion. The UAE is the UK’s 23rd largest trading partner, with a thriving trade relationship.

Latest investments and trade deals, like Mubadala’s £800 million into British life sciences, signify a strengthening partnership. The Sovereign Investment Partnership’s expansion and relaxed UAE laws aim to attract talent.

As a global destination, the UAE offers opportunities in Real Estate, Travel, Tourism, Hospitality, Trading, Agritech, Cloud Computing, Augmented Reality, and Virtual Reality.

The future-driven UK-UAE relationship, marked by excitement and confidence, is set to grow stronger with more British entrepreneurs venturing into the Emirates.

- Flourishing Trade Ties

In 2024, during the 13th Ministerial Conference of the World Trade Organization, it was noted that the current trade and investment relationship between the UK and the UAE exceeds £25 billion, with over £10 billion of UAE investments in the UK over the past three years.

“Lord Udny-Lister, co-chair of the UAE-UK Business Council, highlighted that over 13,500 UK companies are already exporting to the UAE, and this is expected to grow further with the impending UK-GCC Free Trade Agreement.”

With the world reopening and Brexit fostering new trade dynamics, economists predict a surge in British-backed startups in the UAE.

- Factors Driving UK Investment in the UAE

Recent policy changes include allowing 100% foreign ownership of onshore company registration in Dubai as well as in other parts of UAE – previously requiring Emirati majority ownership.

Long-stay visas and streamlined regulations, facilitated by companies like Avyanco UK, make establishing a business more attractive.

The UAE actively welcomes international investment, evident in initiatives like the Golden visa specifically designed for entrepreneurs and investors.

The UAE prioritizes human capital and offers visa opportunities tailored to attract skilled individuals in sectors like AI, healthcare, and sustainability.

Initiatives like flexi-desk workspaces and government incentives ease operational costs for startups.

The UAE-UK Sovereign Investment Partnership signifies a long-term commitment to fostering economic growth through joint investments.

- Taxation Considerations

One of the most attractive aspects of establishing a business in Dubai is its tax-friendly environment. UK companies in the UAE can enjoy minimal to no corporate tax, and there is no personal income tax. Value Added Tax (VAT) does exist, however it is just at 5% for businesses conducted within the local markets, 0% for businesses done outside UAE.

- Support for British Businesses in the UAE

To open a company in Dubai or any other Emirates you need support! Several governmental support groups such as the British Chamber of Commerce Dubai or Dubai Chamber of Commerce among others provide invaluable support for British entrepreneurs:

- They organize networking events, and workshops, as well as offer guidance for newcomers.

- With a large and active membership, the group fosters a sense of community for British expats.

The UAE and the UK share a dynamic and mutually beneficial business relationship. With the UAE’s proactive approach to attracting foreign investment and the UK’s entrepreneurial spirit, this partnership presents immense potential for future growth and success.

Company Registration in Dubai, UAE: Legal and Regulatory Framework for UK Nationals

For UK nationals contemplating company registration in Dubai, UAE, understanding the legal and regulatory is crucial. Dubai’s appeal lies in its growth potential, economic favourability, robust infrastructure, technological innovation, and efficient logistics. However, navigating the company registration process in Dubai requires careful attention to various factors.

- Company Formation Options

The first crucial decision involves selecting your business location within Dubai. The jurisdiction not only determines the company’s location but may also come with specific limitations and criteria. Prospective business owners must thoroughly research available jurisdictional options and select one that aligns with their company’s nature.

Broadly, two primary options exist:

- Mainland: You can now enjoy 100% ownership of your company in Dubai Mainland business setup. As a UK national, you will enjoy complete control over your company – you are the boss, calling the shots and reaping the rewards.

Here’s what makes the UAE mainland a launchpad for your success:

- Be Your Own Boss: No need to share ownership. It’s 100% your company.

- Location Freedom: Set up shop anywhere in the UAE. Bustling Dubai, the cosmopolitan capital Abu Dhabi, or any other strategic Emirate that fits your vision. You choose!

- Banking Made Easy: Opening a corporate bank account is a breeze in the UAE.

- Attract Top Talent: Streamlined employee visa processes let you recruit the best and brightest from across the globe, building a dynamic team.

- Local & Global Reach: Serve both the thriving UAE market and a global clientele. Your business won’t be confined by borders.

- Tax Benefits: 0% Income Tax, 0% Withholding Tax and Low Corporate Tax.

- Free Zones: Free Zones are like self-contained business havens – perfect if you want a quick company setup with minimal paperwork to deal with. However, Free Zones typically restrict selling directly to UAE consumers (business-to-consumer, or B2C). So, if you are envisioning a retail store or a service catering directly to locals, the mainland might be a better fit.

Nonetheless, free zones offer a heap of benefits:

- Mix & Match Business Activities: Unlike the UAE mainland, free zones company formation in dubai let you mix and match business activities on your trade license, giving you the freedom to tailor your operation as per your will.

- 100% Ownership: You can 100% own and operate your business without the need for a local partner – it’s your company, your way.

- Financial Freedom Awaits:

- Tax Minimization: Enjoy significant tax benefits, including 0% Corporate Tax on Qualifying Income (with a de minimis rule for some outside income).

- No Currency Restrictions: Move your money freely – there are no limitations on foreign exchange or repatriation of funds.

- Import & Export Savings: Benefit from exemptions on import and export duties, making your commercials even more competitive.

- Global Hub, Local Launchpad:

- Strategic Connections: Locate your business in a global hub, perfectly positioned to reach international markets.

- Build Your Dream Team: Freely recruit the best and brightest from worldwide with streamlined employee visa processes.

- World-Class Infrastructure: Take advantage of a globally recognized infrastructural setup to excel your business.

- Confidentiality Assured: Operate with peace of mind knowing free zones offer a secure environment for your business activities.

- Thrive in a Connected Ecosystem: Network and forge partnerships with other successful businesses within the established free zone community.

Licensing Requirements

Obtaining a business license is mandatory. This official authorization serves as your permission to operate within Dubai or any other Emirate. A variety of licenses cater to specific business activities, so selecting the most appropriate one is essential.

Essential Documentation

Once you have finalized your location and license type, meticulous preparation of your documentation is crucial. It involves obtaining approvals from the Development of Economic Department (DED) and possibly industry-specific clearances from governmental agencies. In case of Free Zone business setup, the documents process and approvals will depend on the respective Free Zone jurisdiction.

Proper paperwork streamlines the registration process, ensuring efficiency. Key documents include:

- A completed standard application form

- Passports for all Ultimate Beneficial Ownership (UBO) shareholders, directors, and the General Manager. (To move an existing UK company to UAE)

- Legalized and attested copies of your UK company document (if applicable)

- A detailed business plan outlining your vision and objectives

- Audited financial reports for the past two years

- A certificate of reference from your bank (optional, but recommended)

- Foreign company or company business license, MOA, AOA,certificate of incorporation and board of resolution.

Upon collecting these documents, you can utilize your new business license to open a dedicated corporate bank account.

Associated Costs

Understanding and estimating the associated costs is crucial. Whether you have an exuberant budget or are looking for a low-cost business setup in Dubai – you must know the costs involved beforehand. Delays, incorrect approvals, or unfamiliarity with procedures can contribute to increased costs. Entrepreneurs are advised to learn about requirements and, if needed, consult experts to navigate the process efficiently and reduce registration expenses.

Systematic Process

- In case of mainland company setup

Following a systematic process is imperative for successful company formation in Dubai. This involves;

- Choosing a company name,

- Obtaining name and activity approval from DED,

- Securing business premises,

- Drafting the Memorandum of Association (MOA),

- Obtaining any other necessary documentation or permissions,

- Submitting all documents to DED, and paying the relevant fees.

Adhering to this sequential order ensures a smooth and timely company registration process.

- Likewise for free zone company formation

Similarly, each Free Zone with it’s unique benefits and specialization areas also adhere to a systematic process that needs to be followed;

- Securing your company name (if available within the chosen Free Zone)

- Determine the most suitable legal structure,

- Gather essential documents, including copies of passports, business plans, and proof of address for all shareholders and directors.

- Certain Free Zones may require pre-approvals for specific licenses or activities.

- Business pre-approval along with all required documents to the chosen Free Zone authority.

- Selecting the space for your chosen business activity, and visa requirements.

- MOA preparation, business licensing and registration fees – which may vary depending on the Free Zone.

- Next, establish a corporate bank account for smooth financial management.

- Securing visas for yourself, employees, and dependents.

Specific requirements may vary, so consult the chosen Free Zone authority or companies like Avyanco Business Consultancy for a comprehensive list.

Relocating an Existing UK Company to the UAE

Planning to bring your established UK business to Dubai? The process is surprisingly straightforward. You will essentially submit the documents mentioned previously, supplemented by the necessary paperwork from both your UK and UAE companies. In some instances, a No Objection Certificate (NOC) from involved parties may be required.

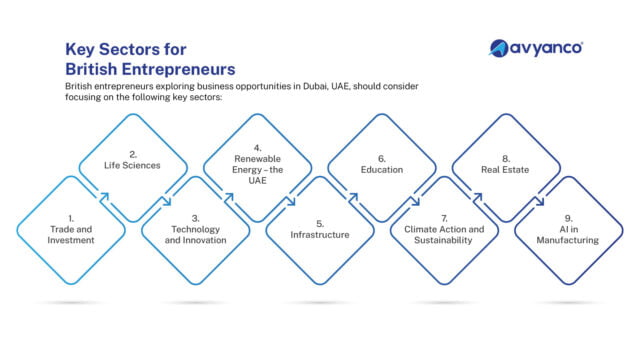

Key Sectors for British Entrepreneurs

British entrepreneurs exploring business opportunities in Dubai, UAE, should consider focusing on the following key sectors:

- Trade and Investment – because UAE is the 19th largest in terms of trade and investment relationships.

- Life Sciences – the investment of Mubadala’s £800 million commitment to UK life sciences displays that UAE is hungry for innovation. This includes healthcare, technology, energy transition, and infrastructure.

- Technology and Innovation – the country’s relentless pursuit of economic diversification and cutting-edge technology creates a perfect place for British tech firms. Mainly those in AI, space, fintech, and innovation, can find exciting opportunities in the region.

- Renewable Energy – UAE encourages Foreign Direct Investment (FDI) giving scope to renewable energy technologies.

- Infrastructure – the UAE’s colossal infrastructure investment plan – nearly USD 2 trillion – coupled with its strategic location, presents a golden prospect for British businesses in infrastructure development.

- Education – there are many upcoming collaborations in the education sector and UAE has plans to provide a key focus on education in 2024, giving British entrepreneurs a chance to excel in this sector.

- Climate Action and Sustainability – the ongoing focus on climate action and sustainability provides British entrepreneurs with opportunities to contribute to collaborations in climate finance, energy transition, and decarbonization.

- Real Estate – the recent changes in laws, including provisions for remote working visas and citizenship for talented expats, make the real estate sector attractive for British entrepreneurs.

- AI in Manufacturing – the UAE’s strategic agenda for 2024 emphasizes campaigns to leverage AI in manufacturing. British entrepreneurs with expertise in this field stand to gain significantly by contributing to this exciting initiative.

These sectors reflect the diverse range of opportunities available for British entrepreneurs in Dubai, encompassing both traditional areas like trade and investment and cutting-edge fields like technology and innovation.

Cultural Considerations and Business Etiquette

By acknowledging and respecting these cultural considerations, you can cultivate a positive and productive business environment. Here are some key aspects to remember:

- Communication Style: Unlike fast-paced business cultures, building rapport is paramount in the UAE. Patience is key, and fostering personal connections before delving into business discussions is essential. Embrace indirect communication, as it often serves as a local trust-building mechanism.

- Dress Code: Although Dubai is a fashion destination, modesty reigns supreme in business attire. Opt for professional clothing that covers shoulders and knees, particularly when venturing beyond tourist areas. A polished appearance signifies respect for local traditions.

- Building Relationships: Business success in the UAE or any other country transcends mere transactions – because in the end, it’s about cultivating trust. So, go out and capitalize on building connections and get involved in friendly conversations to make lasting commercial relationships.

Opportunities for Collaboration and Partnership

Here are some of the collective efforts that contribute towards the development of meaningful collaborations between UK entrepreneurs and their counterparts in the UAE.

- The participation in bilateral platforms, such as the UK-UAE Business Council, provides a structured environment for fostering collaboration.

- Formulating strategic agendas, as exemplified in the UK-UAE Business Council’s plans for 2024, emphasizes strengthening and broadening bilateral knowledge exchange, trade, and investment flows.

- The ongoing trade negotiations, such as the sixth round of talks towards a free trade agreement (FTA) between the UK and Gulf Co-operation Council states, play a pivotal role in creating opportunities for collaboration.

- Business community cooperation involves identifying and eliminating trade barriers and discovering new opportunities to work together.

- Engaging in networking from events to conferences, and trade fairs provides UK entrepreneurs with opportunities to connect with potential partners and collaborators.

- Governmental initiatives, such as economic reforms, relaxed laws, and investment incentives, allow UK nationals to align their business strategies with the evolving in the UAE.

Why Choose Avyanco UK?

If you are a UK national looking for company formation in Dubai, consider choosing Avyanco UK as your business setup service provider:

- Expertise Tailored to You: Avyanco UK offers specialized knowledge of Dubai’s legal scene, ensuring that your business setup process is not only compliant but also tailored to your specific needs.

- Transparent Cost Guidance: When it comes to business ideas in Dubai with low investment, Avyanco UK provides clear and personalized guidance. Our commitment to cost articulation ensures you have a transparent understanding, preventing any unexpected expenses along the way.

- Your Journey, Our Systematic Support: We are committed to guiding you through a systematic and orderly company registration process. From managing approvals and documentation to providing personalized support at every step – we make your journey smoother.

- Ahead of Trends: By aligning with the strategic agendas and priorities set by the UK-UAE Business Council for 2024, we demonstrate our commitment to staying ahead of industry trends.

- Adaptability for Your Success: Avyanco UK’s awareness and adaptability to economic reforms, including recent changes in UAE laws and incentives, make us a forward-thinking partner. We are committed to ensuring you as a UK entrepreneur can leverage new opportunities arising from economic transformations in the UAE.

- Networking for Your Connections: Avyanco UK’s potential involvement in networking events, conferences, and trade fairs means we are actively seeking connections for you. This involvement creates additional avenues for collaboration and partnership, ensuring your business benefits from a network of potential partners.

Plus, with our convenient UK branch office, we are always ready to connect and answer your questions. So, contact Avyanco UK today for expert guidance on establishing your Dubai business journey!

Frequently Asked Questions

What makes Dubai a good choice for UK entrepreneurs?

Dubai is a tax-friendly hub with no corporate tax on profits below AED 375,000 and no personal income tax, making it a great location for business.

How many UK businesses are there in Dubai?

Over 6,000 UK businesses currently operate in the UAE, with Dubai being a top destination for entrepreneurship.

What are the popular industries for UK businesses in Dubai?

Popular sectors include technology, finance, real estate, healthcare, education, and trade.

What’s the tax system in Dubai?

Dubai offers 0% tax on profits below AED 375,000, and a 9% tax on profits above that. VAT is only 5%, and there’s no personal income tax.

Can UK nationals own 100% of a business in Dubai?

Yes, UK nationals can fully own their businesses in Dubai, except for a few regulated sectors.

What is the business setup process in Dubai?

The steps include choosing a location (Mainland, Freezone, or Offshore), selecting the business structure, registering the company, obtaining a license, opening a corporate bank account, and applying for a visa. Each setup has its own specific process.

What documents are needed to set up a business?

The required documents include a passport copy, proof of address, business plan, shareholder agreements (if applicable), and any certifications needed depending on the business type.

What’s the cost of setting up a business in Dubai?

Costs vary based on the location (Mainland, Freezone, or Offshore). Freezone licenses start at AED 6,000, Mainland businesses can cost more, and Offshore setups are typically more affordable.

How long does it take to set up a business in Dubai?

The setup process typically takes 2 weeks to 2 months depending on the business type, the jurisdiction selected (Mainland, Freezone, or Offshore), and the speed of document processing.

What are the benefits of starting a business in Dubai?

Benefits include zero personal income tax, low corporate tax, 100% business ownership (in most cases), easy access to international markets, and the possibility of obtaining a Golden Visa for long-term residency.

What is the Golden Visa for entrepreneurs?

The Golden Visa provides long-term residency to successful entrepreneurs. Eligibility depends on your business type, investment, and innovation in the UAE.

What are the types of business setups in Dubai?

What are the bank account requirements for businesses in Dubai?

To open a corporate bank account in Dubai, you’ll need a trade license, passport copies of shareholders and managers, proof of business address, and a valid residency visa for the account signatories.

What documents are needed for Mainland, Freezone, and Offshore business setups?

Documents required include a passport copy, proof of address, business plan, shareholder agreement (if applicable), and any specific documents required by the chosen jurisdiction (Mainland, Freezone, or Offshore).

What is the process for registering a business in the Mainland?

To register a Mainland business, you’ll need to choose a company name, get initial approval, draft a Memorandum of Association (MOA), obtain a trade license, and register with the relevant authorities. It may also require additional permits depending on the business activity.

What is the process for registering a business in a Freezone?

In a Freezone, you will need to choose your business activity, apply for a license, submit your documents for approval, rent an office space (if required), and finalize your registration with the Freezone authority.

What is the process for registering an Offshore company?

Offshore companies are typically set up for asset protection and tax benefits. The process involves choosing a jurisdiction, submitting documents (passport, proof of address), and obtaining approval from the Offshore authority. It’s often faster and more straightforward than Mainland or Freezone setups.